Major win for Chicago commercial real estate industry and a blow to mayor’s signature campaign promise

Mayor Brandon Johnson, Kasper & Nottage’s Michael Kasper and BOMA’s Farzin Parang (Getty, Kasper & Nottage)

In a major blow to Chicago Mayor Brandon Johnson and a win for the real estate industry, a Cook County Circuit Court judge on Friday blocked a referendum that could have increased the city’s property transfer tax on large real estate deals that was set to be decided in next month’s primary election.

Judge Kathleen M. Burke also denied the Board of Elections’ motion to dismiss the lawsuit brought against the referendum, dealing a blow to the campaign, known as Bring Chicago Home.

The plaintiffs called the combination of both a tax decrease for sales prices under $1 million and an increase for real estate deals totaling $1 million or more a version of “legislative logrolling” that’s prohibited in order to prevent voters from deciding on proposals that would turn both popular and unpopular policies into law with one action.

“This referendum would be a backdoor property tax on all Chicagoans, and it is important that our elected officials not mislead voters otherwise,” Farzin Parang, head of the Chicago chapter of office building trade group Building Owners and Managers Association, said in a statement.

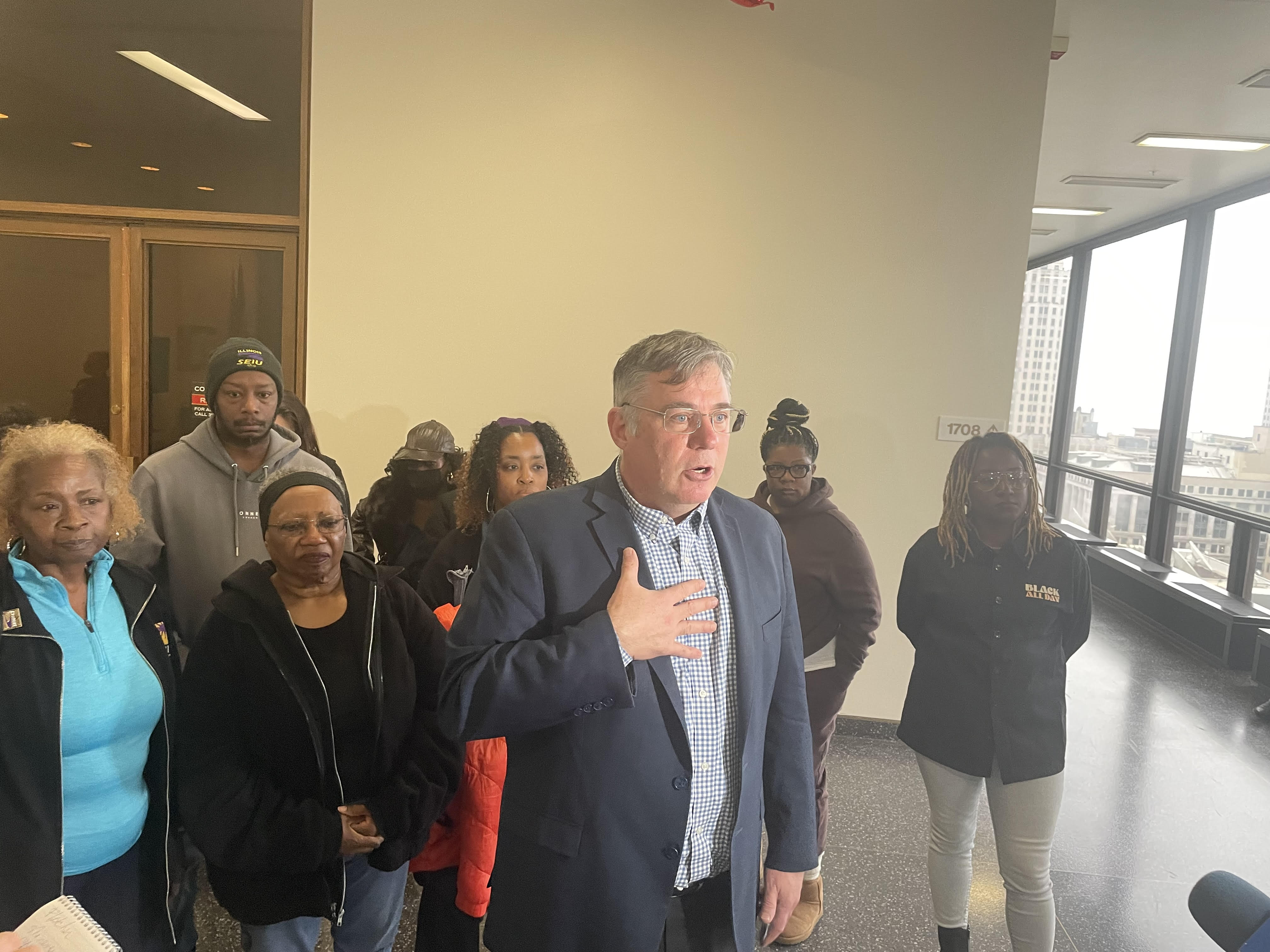

The pews of courtroom 1704 in the Richard J Daley Center were packed as Burke read her ruling. Advocates with the Bring Chicago Home campaign waited eagerly for the decision, though was disappointed by the judge’s decision.

It was not immediately clear whether the city or the Board of Elections would appeal the ruling. The judge also declined to allow City Hall — which was not named as a defendant in the trade groups’ complaint — to intervene in the case.

“It’s supposed to be my city, my vote. And she just got through telling me that my vote doesn’t matter,” Bring Chicago Home supporter Shantonia Jackson said after the ruling.

Because ballots have already been prepared for the March 19 election, the proposed referendum’s language will still appear on the ballots, but election officials will not count the results — unless the defendants or the city successfully appeal Burke’s ruling.

Real estate trade groups claimed that the referendum shouldn’t be held because the ballot language would ask voters to weigh in on a new tiered system for taxing real estate sales in Chicago by asking more than one question. To do so, it would ask voters to approve a transfer tax decrease for transfers under $1 million and two transfer tax increases — one for sales from $1 million to $1.5 million and another for sales over $1.5 million.

If passed by a simple majority of voters, the referendum would have increased the real estate transfer tax imposed on sales of more than $1 million to fund services for people experiencing homelessness, including quadrupling the 0.75 percent rate the city currently charges for deals over $1.5 million.

Under the now-stalled proposal, the rate would have dropped to 0.6 percent for property trades less than $1 million, affecting the majority of local home purchases. Advocates of the plan estimated that upward of 95 percent of sales would get a transfer tax decrease. They also estimated that the tax would generate an additional $100 million in dedicated funds for homeless services each year.

In a years-long push dating at least to when Lori Lightfoot was mayor, Bring Chicago Home advocates had initially pushed to increase real estate transfer taxes on all sales over $1 million without the tiered approach. Lightfoot campaigned on increasing the city’s transfer tax but failed to deliver, upsetting progressive voters.

Johnson’s camp introduced the tiered element in what was viewed by some as a compromise with the real estate industry, and that was the version Chicago City Council ultimately approved for the ballot.

“This transfer tax hike would have resulted in serious ramifications in local neighborhoods,” said Michael Glasser, president of the Neighborhood Building Owners Association, one of the plaintiffs. “Financing housing investments is already challenging in today’s environment, especially when it comes to affordable housing. This measure would have amplified the cost of these types of investments without making housing more accessible, affordable, or improved in any way. It’s difficult to understand how this increase would have helped the homelessness.”

The landlord and developer trade groups who sued are still open to finding other solutions to fund services to combat homelessness and affordable housing construction.

“We need all stakeholders in the room if we want to effectively support those who are unhoused,” Parang said. “It’s time to come together to develop a viable solution for our most vulnerable residents.”

Check back for updates on this breaking story.